There’s an extensive variety of Honolulu solar incentives like tax credits and rebates that residents of Honolulu can take advantage of when making the switch to home solar panels.

This is excellent news for residents, since while Honolulu is known for its pristine beaches and exotic wildlife, it’s also known for having the one of the most expensive electricity rates in the nation.1

By combining state and federal incentives, as well as Honolulu solar incentives, the savings will really add up.

Honolulu residents can offset so much of the initial cost of purchasing a solar system that it makes it surprisingly affordable for anyone to upgrade from outdated and expensive electricity to being powered by the sun.

This comprehensive guide explains what tax credits are available to residents of Honolulu and how to apply for them.

It breaks down federal, state, and local Honolulu solar incentives and what benefits they provide, and helps you calculate how many solar panels your unique home will need, how to choose which solar system to go with, and how much money you can save when you switch.

Solar Panel Tax Credits in Honolulu

How solar tax credits work is that they directly reduce the amount of taxes you owe when you submit your annual tax return in the year you purchase and install your new solar system. This will lower your overall tax bill and let you keep more money in your pocket to offset the costs of your solar system.

Here are the solar panel tax credits available to residents of Honolulu and how to get the most rewards and benefits from each of them.

Renewable Energy Technologies Income Tax Credit

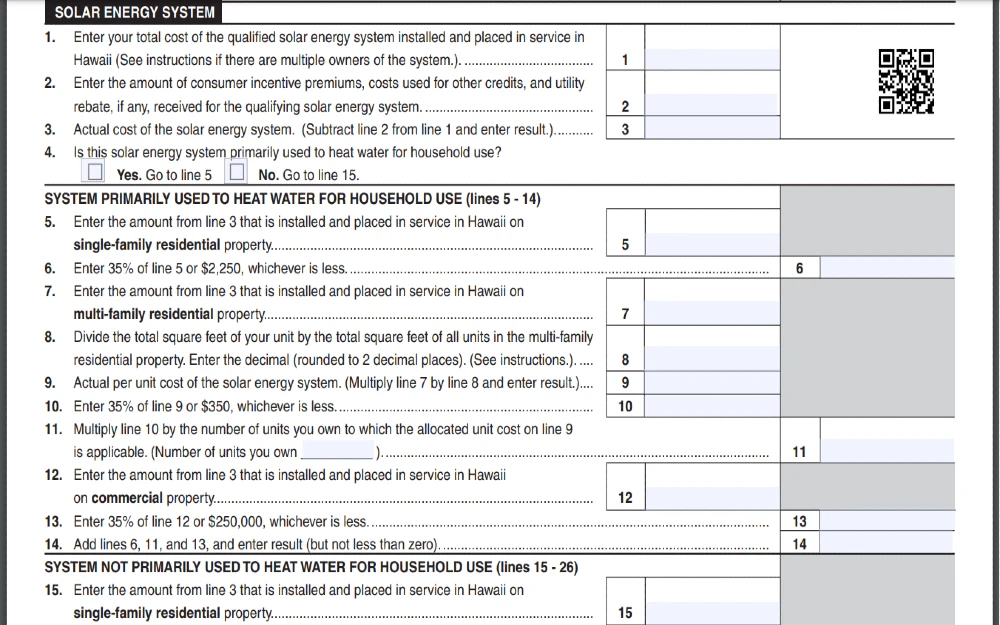

The state of Hawaii offers a tax credit of 35% of the total cost of your solar system, with a maximum credit of $5,000. Claiming this credit is easy and requires simply filling out a form to submit with your state tax return.

Here’s more detailed information on this credit and how to apply.2

Federal Government Solar Incentives

The federal government offers residents of Honolulu a variety of solar incentives, in addition to the ones available from the state.

Let’s look at all the ways you can save on solar in Honolulu, from tax credits and affordable financing options to money-saving rebates.

Federal Clean Energy Tax Credits

The first year you install your new solar system, you’ll get to take advantage of the federal Clean Energy Tax Credit program.3 This program lets you get a tax credit for 30% of the cost of your solar system, and 30% of the cost of your battery storage system.

With this tax credit, there is no maximum amount that can be claimed, which means you’re just about guaranteed to get 30% of your costs back immediately in the first year. Expenses that can be included when requesting your tax credit include the following:

- Solar PV panels and PV cells

- Labor costs for contractors doing onsite prep, assembly and original installation. This includes permit fees, costs of inspection and any developer fees.

- Equipment needed to balance systems, including inverters, mounting hardware and equipment and wiring

- Energy storage devices (such as batteries), so long as they have a capacity rating of at least 3 kilowatt-hours

To get this tax credit, fill out IRS Form 5695 using Form 5695 instructions and include it when sending in your federal tax return.4,5

If you’re asking, “When do federal credits expire?” they will expire fully in 2035 unless Congress renews them.

Honolulu’s Real Property Tax Exemption for Alternative Energy Improvements

While adding solar panels to your home will increase the value of your property, the Honolulu Solar Property Tax Exemption will keep your property taxes from rising for 25 years from the date of installation.6

This fantastic exemption can save you a few hundred dollars a year in assessed property taxes, and for 25 full years.

Fill out a Renewable Energy Claim for Exemption form with the Real Property Assessment Division of Honolulu and make sure to file it on or before September 30th of the year before you plan to claim the exemption.7

Hawaiian Electric Battery Bonus Program

If you add a battery for energy storage to any new or existing solar system, Hawaiian Electric offers cash incentives as well as credits on bills as part of its Electric Battery Bonus Program.8

You’ll get a one-time payment of $850 for every kilowatt of storage output you commit to the program, as well as a monthly bill credit bonus of $5/kW for a full 10 years from the date you enroll in the program.

To sign up for the program, you’ll need to do the following:

- Enroll in a renewable energy rate program that’s approved by Hawaiian Electric

- Have a battery as part of your solar system

- Make sure to use the battery at least 2 hours of every day between the hours of 6 PM and 8:30 PM

- Have and provide your proof of permit application from the permitting office of your county

- Use Hawaiian Electric’s Customer Interconnection Tool to submit your Battery Bonus amendment

- Follow instructions in the Hawaiian Electric Handbook to submit 7 days of operational data

- Fill out an IRS W-9 Form for Owner Operator before your check can be issued.

This can be done electronically, or printed W-9 forms can be mailed to:

Hawaiian Electric

P.O. Box 2750

Honolulu, HI 96840

Attn: AL18-SG. - Payment will be made in 30 days from the date the contract was executed and confirmed.

Note that you don’t have to enroll the full amount of your battery storage into the program if you don’t want to, but you’ll only get the incentive for what kilowatts you enroll.

Affordable Financing Options

If you don’t have the funds to pay for a solar system, there are a few solar financing options available in Honolulu.

These help make sure that everyone can get into the benefits of a solar system, regardless of current financial situation.

GreenSun Hawaii

GreenSun Hawaii helps property owners obtain loans to use towards solar panel system installation with interest rates that are lower than standard, lower minimal down payments, and with payback terms that are longer than other loans.9

To apply for a loan through the GreenSun Hawaii program, just follow these steps:

- Get in touch with an energy contractor near you who’s authorized through the GreenSun Hawaii program, and request a quote for how much it will cost to install solar at your residence.

- After you have your quote, visit greensunhawaii.com to quickly and conveniently submit an application for financing. Your application will be sent to up to 3 GreenSun Hawaii authorized lenders.

You also have the option to apply directly with a lender who participates in the program. - Wait for your approval notification, then schedule the installation and enjoy the lower interest rates and long-term payback period.

Green Energy Money $aver (GEM$) Program

The Green Energy Money $aver Program helps low and moderate-income residents take advantage of lower energy costs on their utility bills without having to pay upfront costs for solar installation.10

GEM$ works similarly to a lease agreement. The energy company takes care of the upfront costs and logistics of installation of a solar system on a rooftop of the household in the program, while the household residents purchase the energy that the solar system generates, and does so at a lower set rate for a period set by the contract.

To learn more and apply for GEM$, visit its page at the Hawaii Green Infrastructure Authority’s website.11

Can I Sell Power Back to the Grid?

In Honolulu, no Net Energy Metering program currently exists. However, other programs and incentives are offered, such as the Battery Bonus program.

Check here for new projects and programs as they are released to residents of Honolulu.12

Net metering works by giving solar system owners billing credits for any electricity they produce and don’t use, and thus add back to the grid for their neighbors and others to use. This is a great incentive for having solar systems that generate more electricity than the household uses.

How Can I Apply for Solar Tax Credits in Honolulu?

The state of Hawaii’s Renewable Energy Technologies Income Tax Credit offers a credit of 35% of the total cost of your solar system, with a maximum credit of $5,000.13

To claim this tax credit after your solar installation, all you need to do is file Form N-342 with your annual Hawaii state tax return.14 This form will ask for information such as the date your system was installed, the total cost of the system, and some details on if or how the system is used to heat water for the household.

After calculating your tax credit, you’ll need that number to complete your tax return and add it to your Schedule CR or Form F-1, Schedule 1. Instructions are provided to make it as easy as possible to complete and get your solar tax credit.15

After the form is complete, send it in with your state tax return.

People often ask, “What Happens If the tax credit is more than I owe, will I get a refund?” The answer is no, you will not get a refund, but you can carry the credit over for several years to ensure it can be used.

Another question commonly raised is, “How does the solar tax credit work if I don’t owe taxes.”16 In this case, you can carry the credit over to another year when you do owe taxes.

Another common question asked is if a roof replacement is required, is that covered by the tax credit? The answer is yes, but the following conditions must be met:

- The solar panels must be owned by you, and not leased

- The building must be owned by you, with your name on the title deed

Note that installation and labor costs of the roof replacement will not be allowed as part of the tax credit.

What Materials and Parts Do You Need for Solar Panel Systems?

Solar systems may seem complicated, but they work in a very intuitive way and don’t require too many materials or parts. This helps keep costs as reasonable as possible, while making sure if anything goes wrong, they’re easy to repair.

They’re also surprisingly easy to install for a qualified, licensed installer.

Here are the general materials and parts for solar panel systems, as well as the estimated overall costs associated with installation of home solar panels.

Solar Panels and Tracking Mounts

Let’s start with the most obvious parts first.

Your solar panel system will need solar panels, which need to be mounted somewhere for prime sun exposure, which is typically your roof. These panels turn the sunlight into usable electricity.

There are 2 main types of solar panels to consider when doing a solar panels comparison, each with different costs and solar panels energy efficiency ratings.

- Monocrystalline panels: These are highly popular for being the most energy efficient (15% to 25%), so you’ll have to buy less of them as part of your solar installation. However, they are the most expensive option.

- Polycrystalline panels: These are slightly less efficient than the monocrystalline panels(11% to 17%) so you’ll have to buy more of them. But each panel will cost less overall.

Special tracking mounts allow your panels to be moved slightly with the sun to stay in the most efficient position, capturing the most sun as possible to convert to usable energy. These mounts must be strong enough to hold heavy solar panels through extreme weather, direct sun exposure and all the elements, so they tend to not be cheap or low quality.

Inverter/Uninterruptible Power Supply (UPS)

An inverter converts the DC power created by the solar panel into AC power, which is usable by home appliances. These devices are also used to charge any batteries that are connected to your home solar system.

Battery and Charge Controller

Batteries help you store power created by your solar panels. This is helpful for creating extra power to send back into the grid, and to ensure you have plenty of usable power on cloudy days when your panels will be creating less energy than you may be using that day.

Charge controllers help ensure that the battery won’t be overcharged.

Disconnect Switches

This will work as a kill switch to fully disconnect your solar system. This will be needed if maintenance needs to be done, or if anything ever malfunctions.

In the event of solar panel problems, you’ll want a disconnect switch.

Wiring and Fuse Box Connections

These are small parts, but they’re a crucial component of every home solar system. This will be where your solar system gets wired into the electric grid of your home to power everything.

This is a notoriously big part of the labor when it comes to installing a solar system as you’ll need someone who knows how to wire solar panels.

Overall, parts and materials tend to cost on average only about 25% of the overall costs of the full solar system installation. The bulk of the costs come from the labor itself, which requires certified and trained solar contractors to work for many hours to ensure the success of your solar system.

In Honolulu, the average cost of a full solar installation, pre-incentives and credits, is from about $15,500 to $20,500.

Solar Calculator: How Much Can You Save?

Once you get the correct amount of solar panels for your home based on energy consumption, your savings will be immediate and reflected in your first electric bill.

This section will explain the solar output calculator so you can get an accurate solar estimate for your needs.

When figuring out how many solar panels for electricity you’ll need to maximize your savings, experts recommend considering factors such as your “geographic location, panel efficiency,17 panel-rated power, and personal energy consumption habits.” When considering those factors, a typical home will need 17 to 21 solar panels.

Grab some paper and get the following information on hand:

- How much electricity you use in a year: You can look at old bills to get this number. Just add up the kilowatt-hours (kWh) used each month for the entire year.

The average American home uses about 890 kWh every month, which equals about 10,700 each year for reference. - How many watts the solar panels are that you’re considering purchasing: Most standard residential solar panels are about 300 or 400 watts per panel. This number is good to know as a starting point, to determine the production ratio.

Factors such as cloudy days will mean the wattage produced versus the wattage of the panels won’t be 1 to 1, but rather a ratio. That’s what the next point is for. - What the estimated production ratio is of the solar power system you’re considering purchasing: The average production ratio in America is around 1.4, but yours may differ depending on what wattage your panels end up being, and what the weather in Honolulu ends up being on average.

The specific formula for calculating how many panels you need is to take your yearly electricity usage and divide that by the production ratio of your area. Then, divide that number by what power output your solar panels have.

Written differently, it’s this:

Number of panels needed = How much electricity you need/production ratio of panels/actual panel wattage

Going with the averages noted above, your formula will look like this:

Number of panels needed = 10,700/1.4/400

In this example, the person would need 19 solar panels to cover 100% of their energy usage if it stayed the same as the year used for the estimate.

How To Choose Solar Panels in Honolulu

When choosing solar panels in Honolulu, it’s important that you find a trusted contractor to help you plan and execute the project.

Solar panels are a true investment in your home and your long-term budget, so you’ll want to work with someone reputable and experienced who will work well with your needs.

Here are some best practices when choosing solar in Honolulu:

Get A Lot of Quotes and References

It’s recommended to get at least 3 quotes from different solar contractors so you can compare what they’re offering and truly find the best person and best deal for the job.

If you have a neighbor or friend who has solar, start with asking if they’d recommend their contractor and seeing how the process went for them. This is a place where you can learn from the mistakes of others, and use word of mouth to connect you to someone worth working with for your solar power system installation.

Be Realistic About Your Needs

When talking with your contractor about your solar panel project, don’t underestimate how much energy you may use.

And don’t overlook little factors such as whether you’re about to have a baby or start a new hobby that uses a lot of electricity. Was the weather more mild than usual in the previous year?

It may be smart to add in an extra panel or two just to ensure your needs are covered, even as your habits change, your family grows, or the weather shifts. And learning as much as you can about solar panel facts can help you make sure you’re getting the best residential solar for your needs.

Don’t Forget About Honolulu Solar Incentives Paperwork

Keep in mind that you’ll be getting a portion of your investment back via tax credits and incentives. With this in mind, keep any documentation and paperwork you receive during the installation process to prove later that you earned the credits.

If you’re considering installing a solar system on your Honolulu home, you can save a significant amount of money by taking advantage of federal and state tax credits, incentives and other ways to save.

Make sure to get a number of quotes from qualified contractors, and be realistic about what size solar system would be best for your needs.

After installation, you’ll start saving money on every electric bill.

Using Honolulu solar incentives can deliver solar energy to your residence at a lower cost, while also contributing to a cleaner environment.

Frequently Asked Questions About Honolulu Solar Incentives

Can I Get Solar Panels Free in Honolulu?

If you’re trying to learn how to get free solar panels in Honolulu, you may have a difficult time finding fully free solar panels. However, with a government solar panel program like tax credits, low rate loans and other financial incentives, your costs can be lowered significantly and almost down to nothing. However, as of now there are no free solar panel programs in Honolulu.

Can I Get Solar Credits in More Than One State?

Yes, you can apply for solar credits in more than one state. If you have multiple residences throughout different states and purchase solar systems for each of them, you can apply for solar credits from each state for each unique solar system.

Are Solar Panels Bad For the Environment?

When looking at the environmental problems with solar panels, it’s a balance like everything else. However, during the solar panel’s long lifespan of 25 to 30 years, they will help offset production emissions in a number of ways. By allowing homes to harness energy from the sun instead of from more polluting methods of energy production, balance can be restored.

With proactive and adequate solar recovery procedures in place to ensure solar panels are disposed of properly at the end of their lifespan, the environmental issues created by solar panels such as toxins leaching into groundwater can be greatly mitigated.

References

1US Bureau of Labor Statistics. (2020, December 16). Average energy prices for the United States, regions, census divisions, and selected metropolitan areas. US Bureau of Labor Statistics. Retrieved October 11, 2023, from <https://www.bls.gov/regions/midwest/data/averageenergyprices_selectedareas_table.htm>

2State of Hawaii. (2023, October 6). Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation. Hawaii Department of Taxation. Retrieved October 11, 2023, from <https://tax.hawaii.gov/forms/a1_1alphalist/>

3Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Office of Energy Efficiency & Renewable Energy. Retrieved October 11, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

4Internal Revenue Service. (2023, February 17). About Form 5695, Residential Energy Credits | Internal Revenue Service. IRS. Retrieved October 11, 2023, from <https://www.irs.gov/forms-pubs/about-form-5695>

5Internal Revenue Service. (2022, December 27). Instructions for Form 5695 (2022) | Internal Revenue Service. IRS. Retrieved October 11, 2023, from <https://www.irs.gov/instructions/i5695>

6Sarkisian, D. (2020, June 25). City and County of Honolulu – Real Property Tax Exemption for Alternative Energy Improvements. DSIRE. Retrieved October 11, 2023, from <https://programs.dsireusa.org/system/program/detail/3684>

7CITY AND COUNTY OF HONOLULU. (2022, November 7). Renewable Energy CLAIM FOR EXEMPTION. City and County of Honolulu | DEPARTMENT OF BUDGET AND FISCAL SERVICES REAL PROPERTY ASSESSMENT DIVISION. Retrieved October 11, 2023, from <https://www.realpropertyhonolulu.com/media/1893/e-8-1012-rev-2022_18_11-fillable.pdf>

8Hawaiian Electric Company, Inc. (2023). Customer Renewable Programs | Battery Bonus. Hawaiian Electric. Retrieved October 11, 2023, from <https://www.hawaiianelectric.com/products-and-services/customer-renewable-programs/rooftop-solar/battery-bonus>

9Glick, M. (2011, November 4). GreenSun Hawaii. Hawai‘i State Energy Office. Retrieved October 11, 2023, from <https://energy.hawaii.gov/wp-content/uploads/2011/09/GreenSun-Brochure_800-KB.pdf>

10State of Hawaii. (2023). GEM$ Energy Services Program. Hawaii.gov. Retrieved October 11, 2023, from <https://gems.hawaii.gov/gem-energy-services-program/>

11State of Hawaii. (2023). Participate Now. Hawaii.gov. Retrieved October 11, 2023, from <https://gems.hawaii.gov/participate-now/>

12Hawaiian Electric Company, Inc. (2023). Private Rooftop Solar. Hawaiian Electric. Retrieved October 11, 2023, from <https://www.hawaiianelectric.com/products-and-services/customer-renewable-programs/rooftop-solar>

13State of Hawaii. (2022, November 22). Renewable Energy Technologies Income Tax Credit (RETITC) – HRS §235-12.5. State of Hawaii Department of Taxation. Retrieved October 11, 2023, from <https://tax.hawaii.gov/geninfo/renewable/>

14State of Hawaii. (2020, December 3). Form N-342, 2020, Renewable Energy Technologies Income Tax Credit. Hawaii.gov. Retrieved October 11, 2023, from <https://files.hawaii.gov/tax/forms/2020/n342_i.pdf>

15State of Hawaii. (2022, December 8). Form N-342 Instructions, Rev. 2021, Instructions for Form N-342, Renewable Energy Technologies Income Tax Credit. Hawaii.gov. Retrieved October 11, 2023, from <https://files.hawaii.gov/tax/forms/2022/n342ins.pdf>

16US Department of Energy. (2023, March 14). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy.gov. Retrieved October 11, 2023, from <https://www.energy.gov/sites/default/files/2023-03/Homeowners_Guide_to_the_Federal_Tax_Credit_for_Solar_PV.pdf>

17Aggarwal, V. (2023, February 2). How many solar panels do I need for my home in 2023? EnergySage. Retrieved October 11, 2023, from <https://www.energysage.com/solar/how-many-solar-panels-do-i-need/>

18Solar Panels @ Ala Moana Photo by Daniel Ramirez / CC BY 2.0 DEED. Resized and Changed Format. From Wikimedia Commons <https://commons.wikimedia.org/w/index.php?curid=56816352>

19Green Energy, RIMPAC 2014, HONOLULU, HAWAII Photo by Staff Sgt. Christopher Hubenthal / Public Domain. Resized and Changed Format. From dvidshub <https://www.dvidshub.net/>